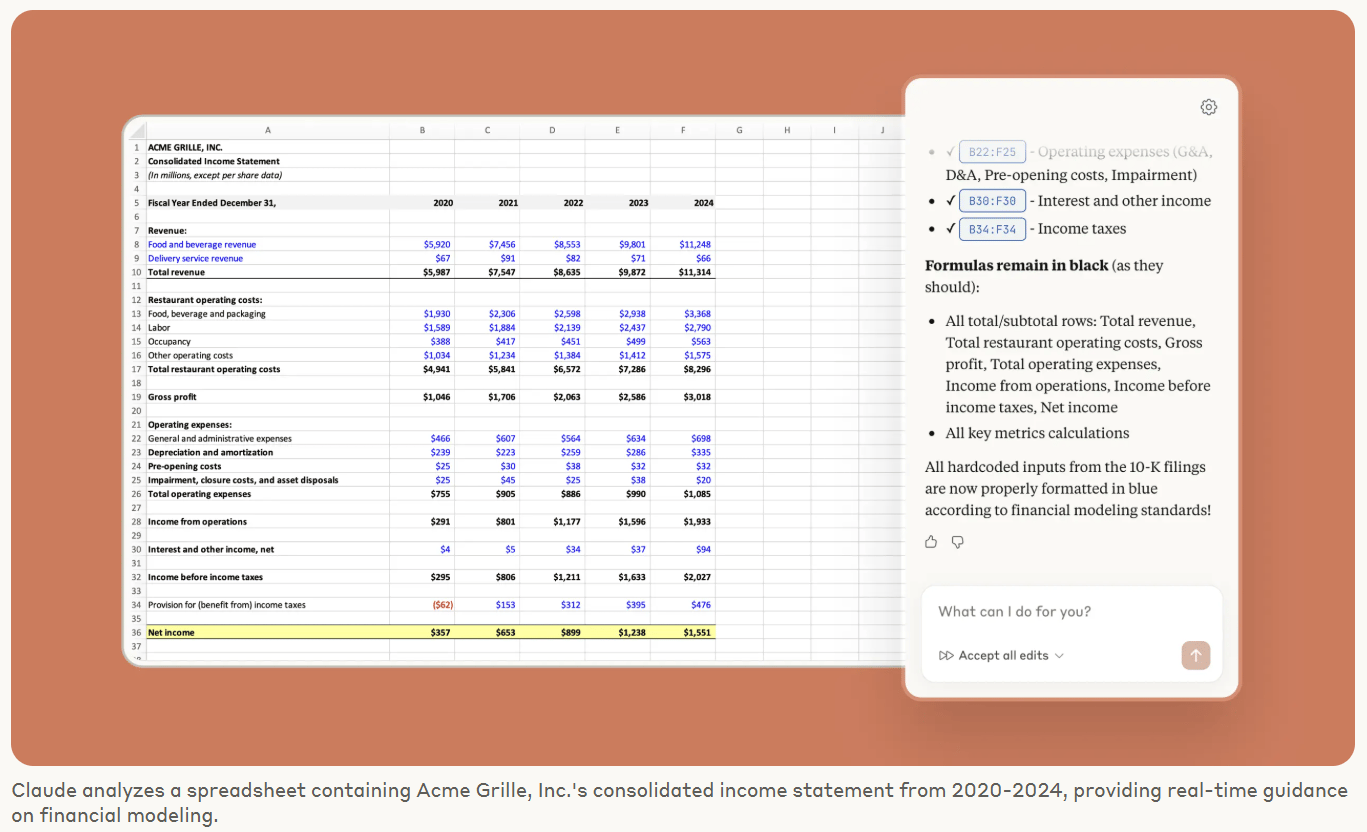

A financial analyst uses Claude’s Agent Skills for Finance in Excel to enhance modeling and data analysis. Image Source: ChatGPT-5

Claude Expands AI Tools for Financial Services with Excel Integration

Key Takeaways: Claude for Financial Services

Anthropic expands Claude for Financial Services with an Excel add-in, new real-time data connectors, and pre-built Agent Skills.

Claude for Excel enters beta, allowing users to analyze and modify spreadsheets directly within Microsoft Excel.

New connectors link Claude to platforms like Aiera, Moody’s, LSEG, and Egnyte for live market data and portfolio analytics.

Six new Agent Skills enable faster financial modeling, due diligence, and valuation analysis.

Leading institutions such as Citi and Coinbase are already integrating Claude into their workflows.

Expanding Claude’s Role in Financial Services

Anthropic is deepening its presence in finance, bringing Claude’s AI directly into Excel and connecting it to live market data for faster, smarter analysis.

The company is expanding Claude for Financial Services with a powerful Excel add-in, additional connectors for real-time market data and portfolio analytics, and new pre-built Agent Skills that can build discounted cash flow models or initiate coverage reports.

These updates build on Sonnet 4.5’s state-of-the-art performance in financial tasks — topping the Finance Agent benchmark from Vals AI with 55.3% accuracy. Together, they extend Claude’s intelligence into core financial workflows, offering AI-powered assistance for time-consuming but critical work within the industry’s preferred tools.

Claude for Excel: AI Inside the Spreadsheet

Anthropic has launched Claude for Excel in beta, marking a major step toward embedding generative AI directly into financial workflows.

The new Excel sidebar integration allows Claude to read, analyze, modify, and create workbooks while maintaining full transparency about every change it makes. Users can review explanations, track cell references, and instantly see how formulas are adjusted.

Claude can:

Discuss how a spreadsheet functions and debug formulas

Modify sheets while preserving structure and dependencies

Populate templates with new data and assumptions

Build new spreadsheets entirely from scratch

This capability extends Anthropic’s existing Microsoft 365 integrations, including support for PowerPoint, Teams, and file searches through Microsoft Copilot Studio. In the Claude apps, users can also create and edit files, including Excel spreadsheets and PowerPoint slides, and connect to Microsoft 365 to search for files, emails, and Teams conversations.

Select Claude models are also available in Microsoft Copilot Studio and Researcher agent, strengthening its interoperability within enterprise ecosystems.

The feature is now in research preview for Max, Enterprise, and Teams users, with rollout expanding after testing with 1,000 initial users. You can join the waitlist here.

Real-Time Financial Intelligence: New Connectors

Connectors provide Claude with direct access to external tools and data platforms, allowing it to analyze information in real time.

In July, Anthropic added connectors for S&P Capital IQ, Daloopa, Morningstar, and PitchBook — giving Claude access to trusted financial databases, equity research, and valuation data used across the investment industry.

Building on that foundation, Anthropic is now introducing a new set of connectors that deepen Claude’s capabilities in market analysis, portfolio monitoring, and due diligence, solidifying its role as a digital research assistant for analysts and portfolio managers:

Aiera: Provides real-time earnings call transcripts and summaries from investor events such as shareholder meetings, analyst presentations, and financial conferences. Aiera’s integration also connects Claude to Third Bridge, a leading expert network platform, giving it access to industry interviews, company intelligence, and market insights from former executives and domain specialists.

Chronograph: Offers private equity investors access to operational and financial data for portfolio monitoring and due diligence, including fund-level performance metrics, valuations, and benchmarking data.

Egnyte: Enables Claude to securely search internal repositories, including data rooms, investment documents, and approved financial models — all while maintaining governed access controls and compliance with enterprise data policies.

LSEG (London Stock Exchange Group): Connects Claude to live market data feeds, including fixed income pricing, equities, foreign exchange rates, macroeconomic indicators, and analyst forecasts of key financial metrics.

Moody’s: Grants access to proprietary credit ratings, research, and company data — including ownership structures, financials, and news on more than 600 million public and private companies. This supports work in credit analysis, compliance, and business development.

MT Newswires: Integrates global, multi-asset class financial news into Claude’s workflow, offering real-time updates on market movements, corporate announcements, and economic developments.

Together, these new connectors turn Claude into a real-time financial intelligence assistant, capable of bridging quantitative data and qualitative insights from across the financial ecosystem — all while maintaining transparency and data security.

For more information on configuring MCP connectors and prompting best practices to get the most from each integration, Anthropic provides detailed setup documentation and examples.

New Agent Skills for Finance

Anthropic is expanding Claude’s financial intelligence with six new pre-built Agent Skills, designed to streamline time-consuming and complex workflows across corporate finance, investment banking, and asset management. Each skill combines structured instructions, scripts, and resources designed to accelerate workflows across Claude.ai, Claude Code, and the Claude API.

The new skills include:

Comparable Company Analysis: Enables Claude to compile and analyze peer company data, including valuation multiples and operating metrics. The analysis can be refreshed dynamically as new financials are released, helping analysts benchmark company performance and update models with current market data.

Discounted Cash Flow (DCF) Models: Allows Claude to build complete free cash flow projections, calculate weighted average cost of capital (WACC), and generate scenario toggles and sensitivity tables.

Due Diligence Data Packs: Processes data room documents into structured Excel workbooks, extracting key financial information, customer lists, and contract summaries.

Company Teasers and Profiles: Automatically generates condensed company overviews for pitch books, buyer lists, and fundraising decks.

Earnings Analyses: Reviews quarterly transcripts and financial statements to extract key performance metrics, guidance changes, and management commentary.

Initiating Coverage Reports: Produces comprehensive research coverage on specific sectors or companies, including industry analysis, valuation frameworks, and competitive positioning.

As with Claude for Excel, these Agent Skills are available in preview for Max, Enterprise, and Teams users. Organizations can register to join the preview and begin testing how Claude performs in production-like financial environments.

Claude’s Impact in Financial Services

Claude is already being adopted across the financial sector by leading banks, asset managers, insurance companies, and fintech firms. It supports a full range of functions — from front-office analytics and client engagement to middle-office underwriting, risk management, and back-office modernization.

By automating repetitive analysis and integrating with existing enterprise tools, Claude helps teams improve speed, accuracy, and collaboration while maintaining oversight and compliance. Anthropic’s continued updates for financial services are aimed at deepening this integration and positioning Claude as a trusted, domain-specific AI assistant across regulated industries.

“Citi chose to leverage Claude as part of its AI-powered Developer Platform because of its advanced planning and agentic coding capabilities, focus on safety and reliability, and compatibility with our workloads,” said David Griffiths, CTO at Citi.

“Anthropic's multi-cloud solution stands out for its scale, performance, and security, aligning with our operational needs and customer expectations. It exceeded our performance benchmarks and met all of our security requirements, making it the ideal solution,” said Varsha Mahadevan, Senior Engineering Manager at Coinbase. “We think Claude will help Coinbase build solutions for different customer segments and bring a billion customers to the crypto economy.”

Research and Product Strategy in Focus

Below, Alexander Bricken, Applied AI Lead for Financial Services, and Nicholas Lin, Head of Product for Financial Services, discuss Anthropic’s research and product strategy within financial services — including real-world customer use cases and insights from the launch of Claude for Financial Services.

Getting Started

To learn more about Claude for Financial Services, readers can visit Anthropic’s official documentation or contact their sales team for deployment details.

To see the new features in action — and hear directly from financial services leaders using Claude in production — Anthropic is also hosting a launch webinar, which you can register for here.

Q&A: Claude’s Growing Role in Financial Services

Q1: How does Claude for Excel differ from traditional Excel add-ins?

A: Claude for Excel doesn’t just automate formulas — it interprets, debugs, and explains them. It acts as a co-pilot for analysis, improving accuracy and understanding.

Q2: Why do the new connectors matter for finance professionals?

A: They give Claude real-time market awareness, allowing analysts to make informed decisions faster while maintaining data governance and compliance.

Q3: How do Agent Skills change financial modeling?

A: They allow Claude to execute complex financial tasks — from valuation to due diligence — without constant prompting, saving hours per model.

Q4: How are organizations applying Claude today?

A: Firms like Citi and Coinbase are using Claude to enhance developer productivity, data analysis, and client-facing tools, integrating AI into every layer of their operations.

What This Means: AI’s Next Chapter in Finance

The expansion of Claude for Financial Services shows how AI is becoming a seamless part of financial work — not a separate system, but an integrated partner.

Analysts, underwriters, and risk managers are beginning to work with AI rather than around it — offloading data-heavy processes while maintaining oversight and compliance.

This evolution doesn’t replace human judgment; it elevates it. As AI takes on the science of finance, the art of interpretation and strategy grows even more valuable.

And as finance evolves, the real advantage will come from those who combine human insight with AI precision most effectively.

Editor’s Note: This article was created by Alicia Shapiro, CMO of AiNews.com, with writing, image, and idea-generation support from ChatGPT, an AI assistant used for research and drafting. However, the final perspective and editorial choices are solely Alicia Shapiro’s. Special thanks to ChatGPT for assistance with research and editorial support in crafting this article.